Tax Sale Results

Serving Tax Sales Investors Since 2005

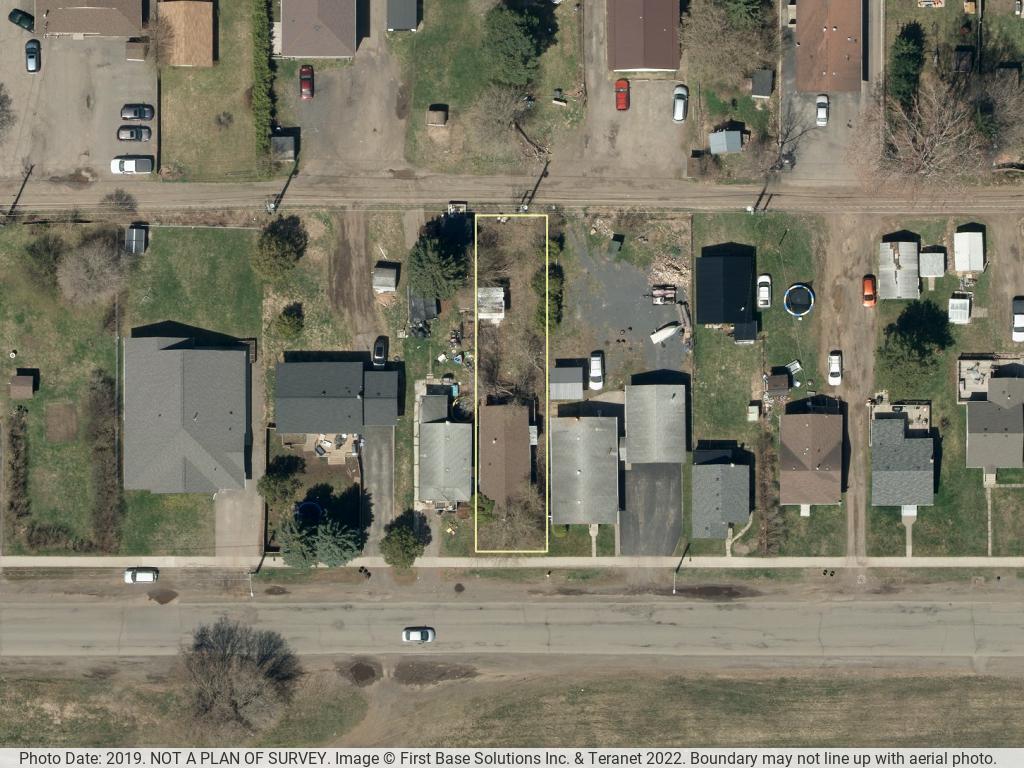

Thunder Bay

Thunder Bay

County: Thunder Bay

Sale Properties:

Tax Sales Results

About new listings, results, cancellations, and more.

This content has been restricted to logged-in users only. Please login to view this content.

Ontariotaxsales.ca

5,294

Every year Ontario municipalities offer hundreds of tax sale properties for sale for prices that are a fraction of market value. By law, municipalities do not have to get market value for the property

Happy Holidays from OntarioTaxSales! We hope your holiday season is filled with peace, warmth, and time with loved ones🎄🎅

Looking at past tax sales can provide valuable insight. You can see what types of properties were sold, what the minimum bids were, and how much they ultimately sold for.![]()

![]() This information helps you set realistic expectations and plan your own bidding strategy.

This information helps you set realistic expectations and plan your own bidding strategy.![]()

![]() Contact us to learn more about past sales data and trends 📈

Contact us to learn more about past sales data and trends 📈

What Happens After You Win?💭 ![]()

![]() Winning a tax sale tender is just the beginning. After you’ve paid the balance and the deed is transferred, you officially become the owner.

Winning a tax sale tender is just the beginning. After you’ve paid the balance and the deed is transferred, you officially become the owner.![]()

![]() From there, you may need to handle repairs, secure the property, or begin plans for development. It’s the start of a new chapter, and preparation will help you succeed.

From there, you may need to handle repairs, secure the property, or begin plans for development. It’s the start of a new chapter, and preparation will help you succeed.![]()

![]() Want to know what comes next? Contact us to learn more!

Want to know what comes next? Contact us to learn more!

Deadlines matter in tax sales. From submitting your tender to making the final payment, missing a date can mean losing your chance to purchase or forfeiting your deposit.![]()

![]() Always mark deadlines clearly in your calendar, set reminders, and give yourself extra time to avoid last-minute problems.

Always mark deadlines clearly in your calendar, set reminders, and give yourself extra time to avoid last-minute problems.![]()

![]() Stay on top of important dates by visiting OntarioTaxSales.ca

Stay on top of important dates by visiting OntarioTaxSales.ca

CLICK HERE

To view surplus property.ca for Ontario Municipal Properties